Thats because theyre carrying the full burden of paying for their Social Security and Medicare. Academiaedu is a platform for academics to share research papers.

Sole Proprietorship Want To Learn More Checkout Accounting Play

This note is developed by the OECD Centre for Entrepreneurship SMEs Regions and Cities CFE.

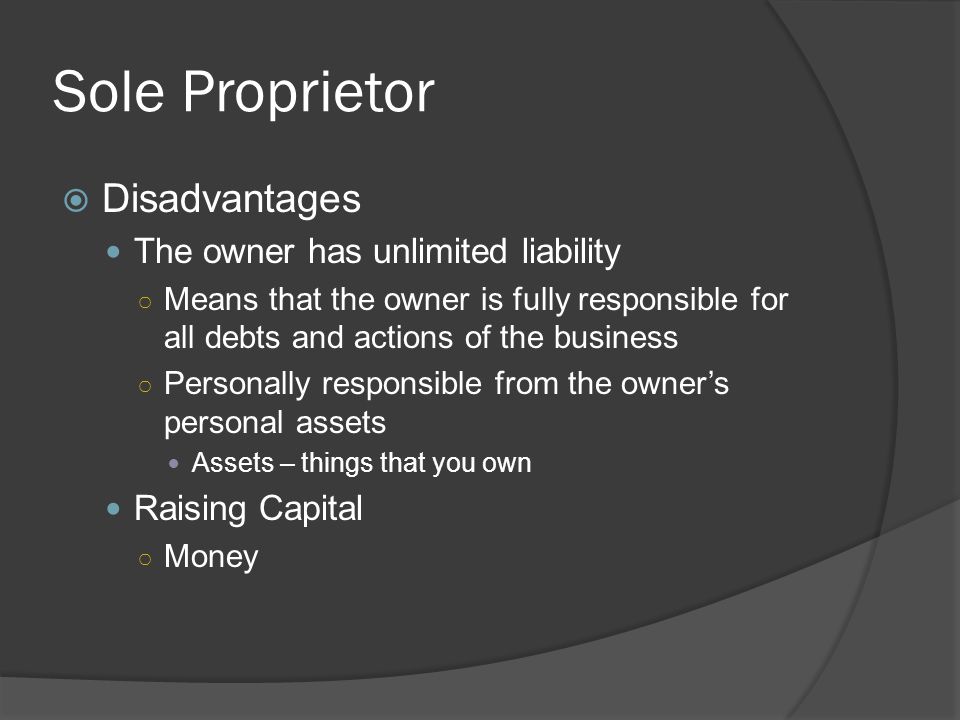

. Many newly self-employed peoplesole proprietors independent contractors and the likeare surprised at their tax bills at the end of the year because they notice theyre suddenly paying a lot more in tax as a self-employed person than as an employee. It examines how SMEs are likely to be affected by the current coronavirus epidemic reports on early evidence and estimates about the impact and provides a preliminary inventory of country responses to foster SME resilience. It means the members have unlimited obligation to meet any insufficiency in the assets of the company in the event of the companys liquidation.

Therefore prior to any such formal liquidation of the company any creditors or security holders of the company may have recourse only to the assets of the company not those of its. So the liability arises only upon the winding up.

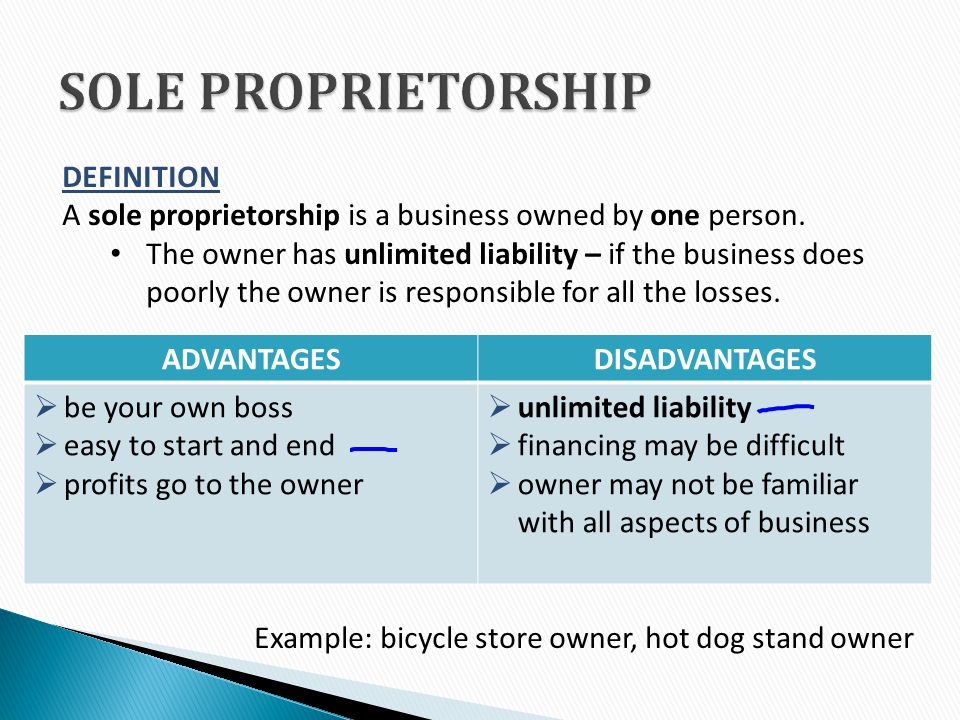

Chapter 2 Forms Of Business Ownership Forms Of Business Ownership Sole Proprietorship Owned By One Person Franchise One Business Licenses Another Ppt Download

0 Comments